Not known Details About Independent Financial Adviser

Besides really feeling great about providing audio suggestions as well as producing a strong monetary structure for their clients, monetary consultants can reap various other benefits for themselves, such as limitless income, job schedule versatility, and also control over their technique. However, this occupation likewise brings particular negative aspects, such as a high-stress atmosphere, problem in developing a customer base, as well as meeting regulative demands.

Offering Rewarding Suggestions Providing clients significant suggestions is among one of the most satisfying elements of this profession. Providing education and learning to overloaded and also overwhelmed customers as well as guiding them to financial investments or insurance policy lorries that are most fit for them is really rewarding. Financial success for a client is strongly attached to a financial adviser's success.

Creating functioning hours that fit best with way of life and home demands enables monetary consultants the capability to balance between individual as well as expert obligations. Unrestricted Earnings Prospective There is no limitation on gaining potential for most economic advisers, as a lot of experts work on a compensation basis. This implies earnings is based upon just how much brand-new organisation or repeating income there is every year.

There is, of training course, much work to do at first in order to construct a solid client base from square one. Gradually, a consultant's track record as well as hard work will assist him/her earn what they're worth. Arrange Flexibility Once a financial advisor establishes a solid client base, they will certainly have much more flexibility in their work hours.

Some Known Questions About Financial Advisers.

Reduced Start-Up Prices There are extremely few costly charges that are connected with this occupation outside of the licensing needs and regulatory prices. This makes it very viable to begin working part-time if needed to construct up a customer base. Specific niche Opportunities There are a selection of products as well as approaches offered in this profession, which permits one the possibility to craft a specific niche career that can be different from the various other financial experts in your particular location (for instance, offering baby boomers or millennials). Independent Financial Adviser.

High-Stress Industry The monetary services industry is deeply intertwined with the performance of the financial markets. Customers connect to their economic advisors when markets choke up, and also are usually psychological and troubled when there is a recession in the marketplace (Pension Advisers Edinburgh). It can be very demanding to manage the feelings of clients.

Therefore, advisers are continuously seeking brand-new prospects, and a wonderful bargain of time as well as money can be originally spent producing and also preserving successful prospecting systems. Financial consultants require to be prepared to duplicate their marketing efforts lot of times, especially when very first getting going, to safeguard the required customer base.

Concentration Having this top quality is specifically real for economic advisors that are freelance as well as functioning from home. Social media diversions, chatting on the phone, or running tasks are all simple distractions as well as impede concentration. Work needs to come initially, and also not everybody is good at making this a priority. Regulatory/Compliance Requirements Acquiring licenses can be extensive.

Rumored Buzz on Pension Advisers Edinburgh

They need to likewise carry errors as well as noninclusions insurance protection throughout their jobs. Keeping up with these regulatory requirements can be pricey as well as time-consuming. Sponsorship The majority of licenses can just be acquired when a sponsorship from a broker agent firm is gotten. Because companies do not normally give out sponsorships, the regular path is to locate job at a company, help a specific amount of time, obtain the certificate, and after that set out on one's very own after the contract has been solved.

There can be a great deal of uncertainty in the very first 5 years that can be difficult to deal with if there isn't other income coming in. However, with a strong work principles and a great deal of tenacity, it is extremely feasible to create a long-term and lucrative career. Financial Advisors are additionally referred to as: Financial Consultant Financial Investment Expert Licensed Financial Coordinator Financial Coordinator Financial Therapist - Financial Advisers.

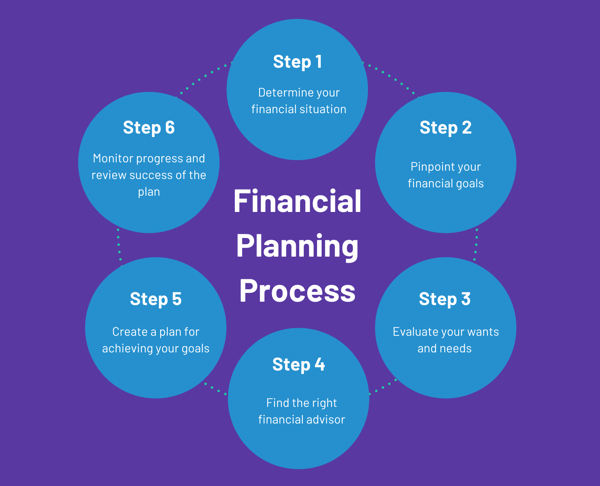

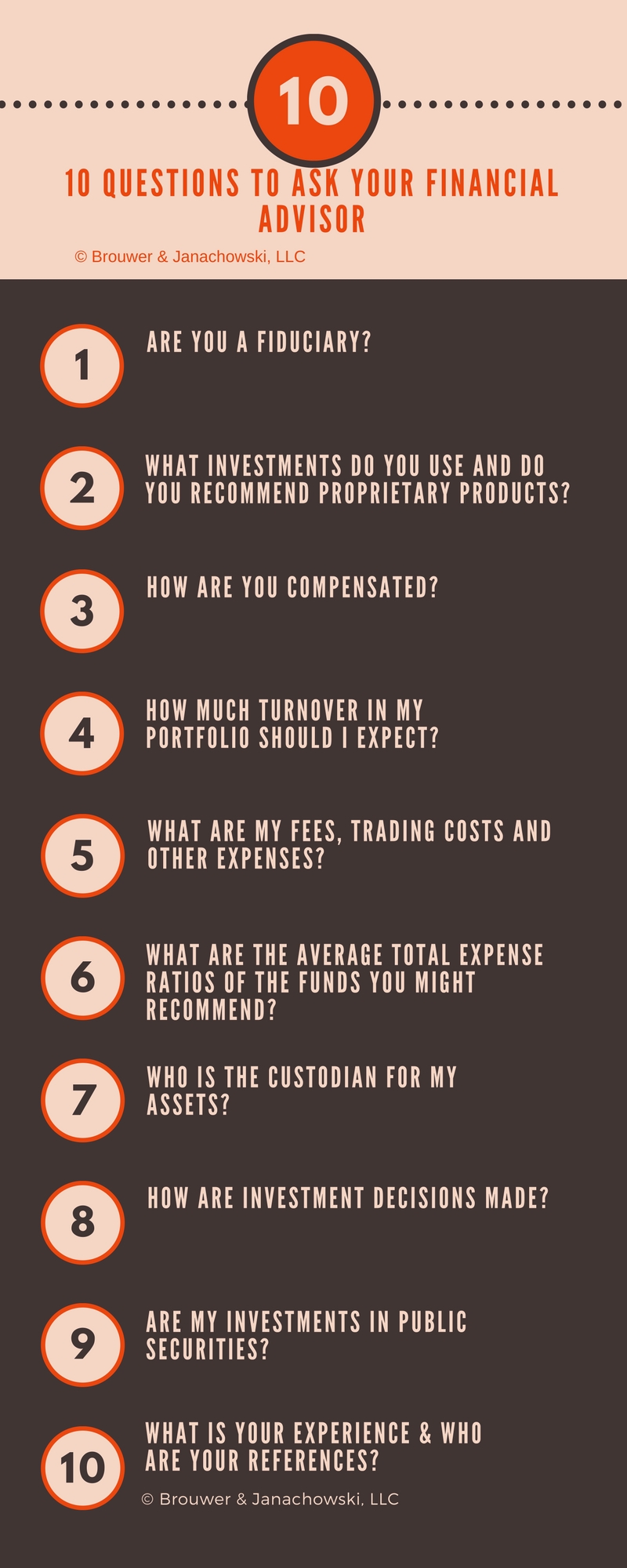

Expert monetary consultants accomplish a 'fact find' where they ask you thorough concerns about your circumstances, your goals and exactly how and also exactly how much threat you are able as well as ready to take with your investment. Then may they advise monetary products that are ideal as well as budget friendly for you. Financial advisers provide services varying from general economic planning as well as financial investment suggestions, to much more specialist suggestions, such as the viability of a specific item such as a pension plan.

pension plans), while others offer a 'limited' solution definition that the array of products or companies they will certainly look at is restricted. If you purchase an investment item based upon economic advice and also a referral, you must obtain an item that meets your demands and also appropriates for your specific conditions.

An Unbiased View of Independent Financial Adviser

You likewise have a lot more security if points fail if you buy based upon recommendations. As an example, defense would be provided where improper advice was provided, or your consultant is found to have actually not acted in your benefits. Similarly, non-advised financiers would additionally be secured if they were misdirected or mis-sold an item.

In this case you're purchasing based on 'details' and they will normally not be examining whether a details item is suitable for your specific situation/needs. Which implies you will certainly have fewer rights to claim payment if the item becomes improper. By comparison, if you end up with an inappropriate item after getting recommendations and a recommendation you might have a situation for 'mis-selling' though this does not safeguard you against making losses if the marketplace goes up or down.

If you're uncertain if you require guidance, why not make an appointment to discover what they can do for you? The guidelines on charges for monetary advice changed from 31 December 2012. If you are looking for general monetary preparation suggestions or for advice on acquiring specific financial investments you will likely pay a fee.

his explanation click this link my response